In every tax debate, Democrats bring up the “fair share” argument but with no definition of fairness. As we found in research earlier in the year, people viewed the concept of “fair share” as more of an emotional argument to punish the wealthy rather than a specified rate. Two-thirds of the electorate (64%) see it as a general view that the wealthy and corporations can afford to pay more in taxes without much difficulty rather than a specific tax rate or dollar amount (21%).

When it comes to tax rates, how high is too high even on the wealthiest individuals? From our recent research for the S Corporation Association (May 13-15, 1000 registered voters), voters were asked what would be the maximum rate at which each of these entities should be taxed?

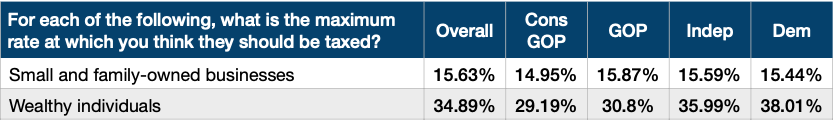

For small and family-owned businesses, the maximum tax rate voters thought they should pay — 15.63% — is much lower than the current rates that they are paying. Across party, the response was around 15-16%.

For wealthy individuals, the maximum rate that voters thought they should be paying is about 35%. Conservative Republicans put the rate lower around 29%, with Republicans overall putting the top rate around 31%. Democrats specified a maximum rate of 38% — but this is still lower than the top rate that would occur if the TCJA provisions expire (39.6%).

The idea of “fair share” in taxes has become an emotional narrative that implies a never ending increase in tax rates. But when pressed about the maximum rates that should be paid, the electorate is reasonable in how they define them.